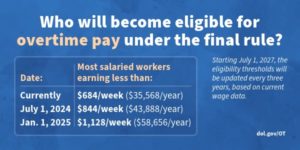

The U.S. Department of Labor (DOL) recently announced a Final Rule that raises the minimum salary threshold by 65% under the Fair Labor Standards Act (FLSA). The Final Rule institutes a notable increase in salary requirements for the “white collar” exemptions, which include executive, administrative, and professional roles. Previously set at $684 per week ($35,568 annually), the standard salary level will now escalate in two stages:

• July 1, 2024: Increases to $844 per week ($43,888 annually)

• January 1, 2025: Rises to $1,128 per week ($58,656 annually)

Changes to the threshold for highly compensated employees (HCE) will also take effect.

Steps Businesses May Consider Around New OT Rule?

1. Review each employee’s classification. Then, consider the next steps for impacted employees. Will you consider adjusting an employee’s salary or reclassifying them as non-exempt? Note that changing an exempt employee to nonexempt status includes other considerations on pay, including how compensation such as bonuses might impact the calculations of any overtime pay owed to the reclassified employee. Determine which currently exempt employees will fall below the new salary thresholds. This is essential for planning necessary salary adjustments or reclassifying employees. Employees close to the new thresholds who meet the duties test for exemptions should consider raising their salaries to maintain their exempt status. This not only ensures compliance but also helps retain talent by avoiding reclassification.

2. Consider unintended ways reclassification could affect your business. Overtime expenses might rise, employee morale might dip, turnover might increase, some employees might perceive themselves as having been demoted, benefits tied to compensation could change, etc.

3. Revisit policies on the use of company equipment and hours worked. Policies should be reviewed to ensure they clearly set forth any expectations for exempt and nonexempt employees about using company equipment and personal devices outside of work hours and while traveling for business.

4. Provide advance notice and proper training. Check to see whether your state or local jurisdiction has laws requiring advance notice of wage changes. Employees reclassified as nonexempt should receive training on relevant company policies or procedures, including timekeeping, meal and rest breaks, approval for overtime work, and more.

5. Regularly audit wage and hour practices to ensure ongoing compliance with both federal and state laws. This is particularly important as some states have higher minimum salary requirements or different exemption criteria than the FLSA.

6. Stay updated on any judicial decisions or changes that could affect the implementation of these changes. Given the historical context and the potential for legal challenges to new DOL rules, it’s crucial to stay updated on any judicial decisions or changes that could affect the implementation of these changes.

If you have any questions regarding this Blog, please contact me!