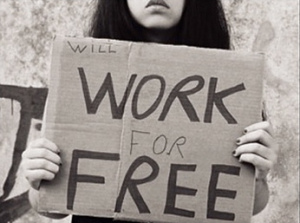

Companies using unpaid interns need to review and update their internship programs and policies to comply with federal and state wage and hour standards.

Companies using unpaid interns need to review and update their internship programs and policies to comply with federal and state wage and hour standards.

Employers can protect themselves from FLSA (Fair Labor Standard Acts) violations by having a clear understanding of what classifies an employee as a “trainee,” what the requirements set by the U.S. Department of Labor (DOL) mean and how to structure internships.

Companies should remember the basic rule that they must pay all employees minimum wage and overtime pay under the FLSA and state wage and hour laws. The FLSA does not have a “student intern” exemption and therefore must be paid by the basic rules outlined by the law. Furthermore, employers should evaluate their state laws. Many states have stricter tests for unpaid interns than the federal standards. The DOL does provide guidance to employers regarding “trainees” and has recognized student interns MAY qualify. What this means is that student interns may qualify as “trainees” and employers are not required to pay them minimum wage or overtime.

Who Qualifies as Trainees?

In structuring unpaid internship or trainee programs, employers must follow the significant requirements the law imposes to qualify someone for this unpaid category.

The DOL has set forth six mandatory requirements for someone to be considered an unpaid trainee:

- The training, even though it includes the operations of the employer, is similar to that given in a vocational school. The more the internship resembles an educational program, the easier it is for an individual to qualify as a trainee under the FLSA.

- The trainee must genuinely be acting for their own benefit. The training is for the benefit of the trainees or students. DOL officials look for internships that increase the intern’s chances of being hired in the job market or situations where students receive academic credit toward graduation. This means the tasks must be useful only for training purposes and can be of little benefit to the employer.

- The trainee or student cannot displace regular employees and must work under close observation. Employers should not expect or entrust an intern to do the same work as regular employees. Further, an employer should not hire an intern to assume the job duties of a recently departed employee.

- The intern should not be responsible for doing significant “actual productive work.” If an intern accomplishes any productive work, it should be insubstantial in nature and secondary to the training.

- The trainee is not entitled to a job at the end of the training. To ensure that the intern has no expectation of employment, the DOL recommends that an employer draft a written agreement with the intern stating that the student should have no expectation of employment and should not presume any guarantee of employment after the internship.

- The employer and trainee understand that they are not entitled to wages for the time spent in training. Before beginning the relationship, Companies should draft a written agreement stating that payment for the intern’s services is neither intended nor expected during the internship.

References:

- O’Donnell, L.E. (4/1/2016) Legal Trends Vol. 58 No. 4 Is Your Unpaid Internship Program Lawful?

- SHRM article: Unpaid Interns Sue ‘Black Swan’ Production Company for Wage and Hour Violations (Legal Issues)

- SHRM article: Some Internships Might Be Challenged as Off-the-Clock Work (Legal Issues)